MUMBAI: The Siddhivinayak temple here will deposit its stock of gold offerings in the Central Government's scheme. Siddhivinayak is one of the country's richest temples. The decision to transfer some of its gold reserves weighing 40 kg to the Gold Monetisation Scheme of the Centre will yield the temple Rs 69 lakh in annual

interest.

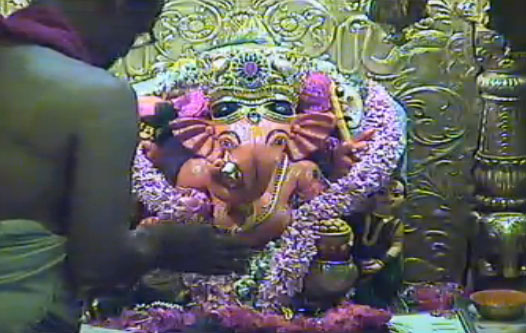

Click and Pray Online!!!

The Siddhivinayak is the first shrine to join the scheme and this might boost the prospects of other big shrines like Tirumala and Shirdi following suit as there has

been little response to the scheme so far. It is estimated that there is about 20,000 tonnes of gold lying idle across the country.

The gold deposited will be melted at the Government mint, impurities removed, and preserved in the shape of biscuits. There will be substantial loss in weight as

the ornaments donated by the devotees vary in quality. The reduction can be a massive 20 to 25 per cent, three times what the jewellers discount. The Siddhivinayak temple is likely to earn 2 to 2.5 per cent interest as per the scheme, roughly the amount coming to Rs 69 lakh in annual interest, it was reported. The temple has a total of 165 kg of gold, of which it has offered 40 kg for the scheme.

Gold and its ornaments are some of the precious things devotees offer at the altar of temples in India to appease Gods and Goddesses.

According to temple trust officials, the interest earned will be used for providing medicare to the needy and economically backward patients.

The 5000 years old Tirupati Sri Venkateswara Swamy temple has a reserve of 5.5 tonnes of the yellow metal. The temple has already deposited a large quantity of

its gold with banks under previous such schemes for an annual interest of 1 percent. It is yet to decide on the new scheme. The Tirupati temple gets offerings

of about one tonne of the yellow metal every year on an average.

The Central Government had come out with the much publicised scheme to persuade individuals, institutions and temples to part with their gold stocks to be

preserved as Government reserves to reduce import bills. Gold constituted 28 per cent of trade deficit in the last financial year. India is the second biggest importer

of gold, China taking the first slot.

As per the scheme, banks will take the gold deposits for up to 15 years to auction

or lend to jewellers. The interest paid to the owners of the jewellery who surrender the gold will be 2.25-2.50 per cent a year. Earlier the rate was 1 per cent.

The Finance Ministry had stated that the scheme "will help in reducing our gold imports and save foreign exchange and deal with the problem of current account

deficit." The Centre is also planning to ban imports of 24-carat gold jewellery.